Net tax calculator

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. Tax change calculator.

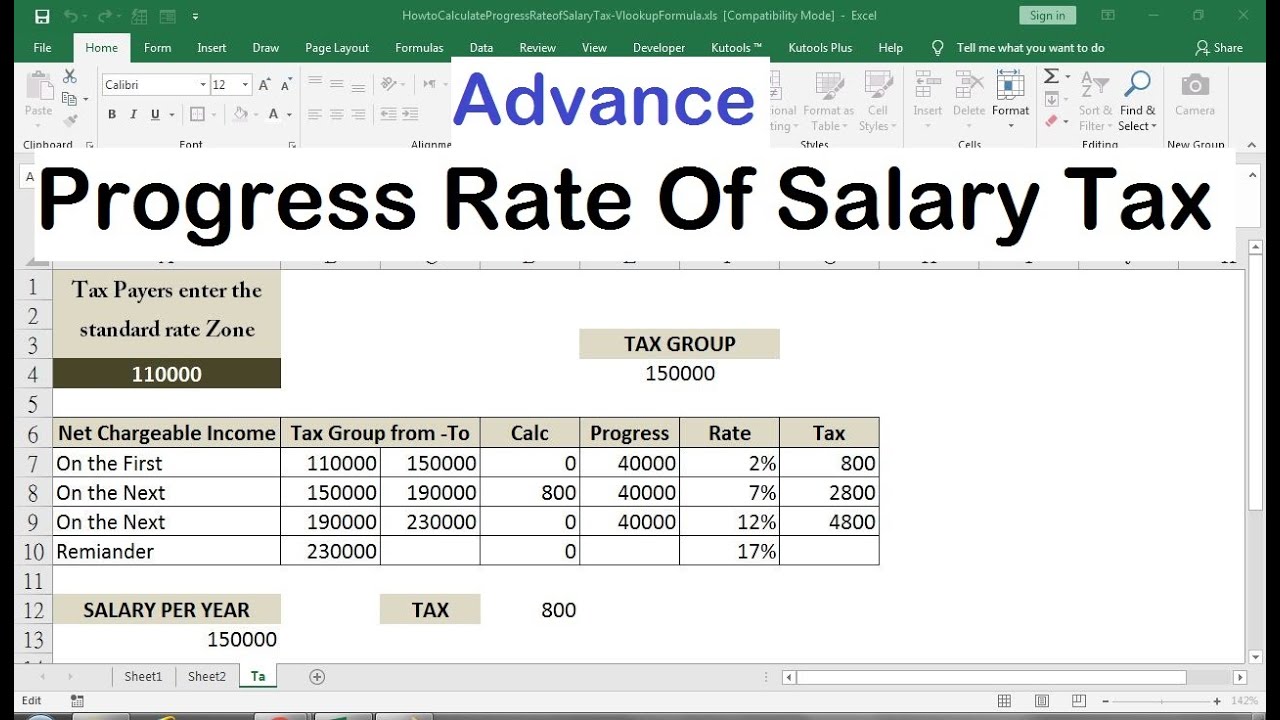

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Income tax will be cut by one penny to 19 for all with the 45 top rate of tax also to be abolished.

. Transfer unused allowance to your spouse. Estimate your tax refund with HR Blocks free income tax calculator. See where that hard-earned money goes - with UK income tax National Insurance student.

Prepare federal and state income taxes online. Student loan pension contributions bonuses company. That means that your net pay will be 43041 per year or 3587 per month.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. That means that your net pay will be 40568 per year or 3381 per month. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

How to calculate annual income. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. See how much you will save.

For example if an employee earns 1500. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Holding Period Return Calculator.

The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Use this calculator to see how inflation will change your pay in real terms.

Free tax code calculator. FAQ Blog Calculators Students Logbook. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Stock Non-constant Growth Calculator. This calculator works out an employees net pay by subtracting PAYE NSSF NHIF and pension fund contribution from the monthly gross pay.

Ad Enter Your Tax Information. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Weighted Average Cost of Capital Calculator.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. This Calculator calculates tax and salary deductions with.

We would like to show you a description here but the site wont allow us. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Your average tax rate is.

See What Credits and Deductions Apply to You. Tax Financial News. Check your tax code - you may be owed 1000s.

Input the date of you last pay rise when your current pay was set and find out where your current salary has. 11 income tax and related need-to-knows. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

See where that hard-earned money goes - with Federal Income Tax Social Security and other. The Tax Caculator Philipines 2022 is. ATL - Lates Tax Financial News Updates.

In order to work out taxable pay the. 18 of taxable income. See where that hard-earned money goes - Federal Income Tax Social Security and.

40680 26 of taxable income. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000.

Gross Net Calculator 2022 of. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Thats where our paycheck calculator comes in.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. How Do I Figure Tax Percentage From Total. Income Tax Calculator Income Tax Calculator provides a quick and easy way to calculate your tax in a beautifully designed app.

E-File your tax return directly to the IRS.

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Income Tax Calculator App Concept Calculator App Tax App App

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Tax Calculator Calculator Design Financial Problems Calculator

Pin On Airbnb

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Excel Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Pay Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Self Employed Tax Calculator Business Tax Self Employment Financial Management

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Payroll Taxes

Free Net Worth Calculator For Excel Personal Financial Statement Net Worth Welcome Words

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure